“A prediction about the direction of the stock market tells you nothing about where stocks are headed, but a whole lot about the person doing the predicting.” – Warren Buffett

“Where are we headed?” I get that question a lot. No one can predict the outcome with consistent accuracy. I talk about this in FFF#41. The magic is not in predicting storms; it is the preparation to withstand them while enjoying the sunshine.

What can help is understanding the principles of investing. These core concepts can help you make better decisions in various environments.

5 Insights to Understand Markets in 2024

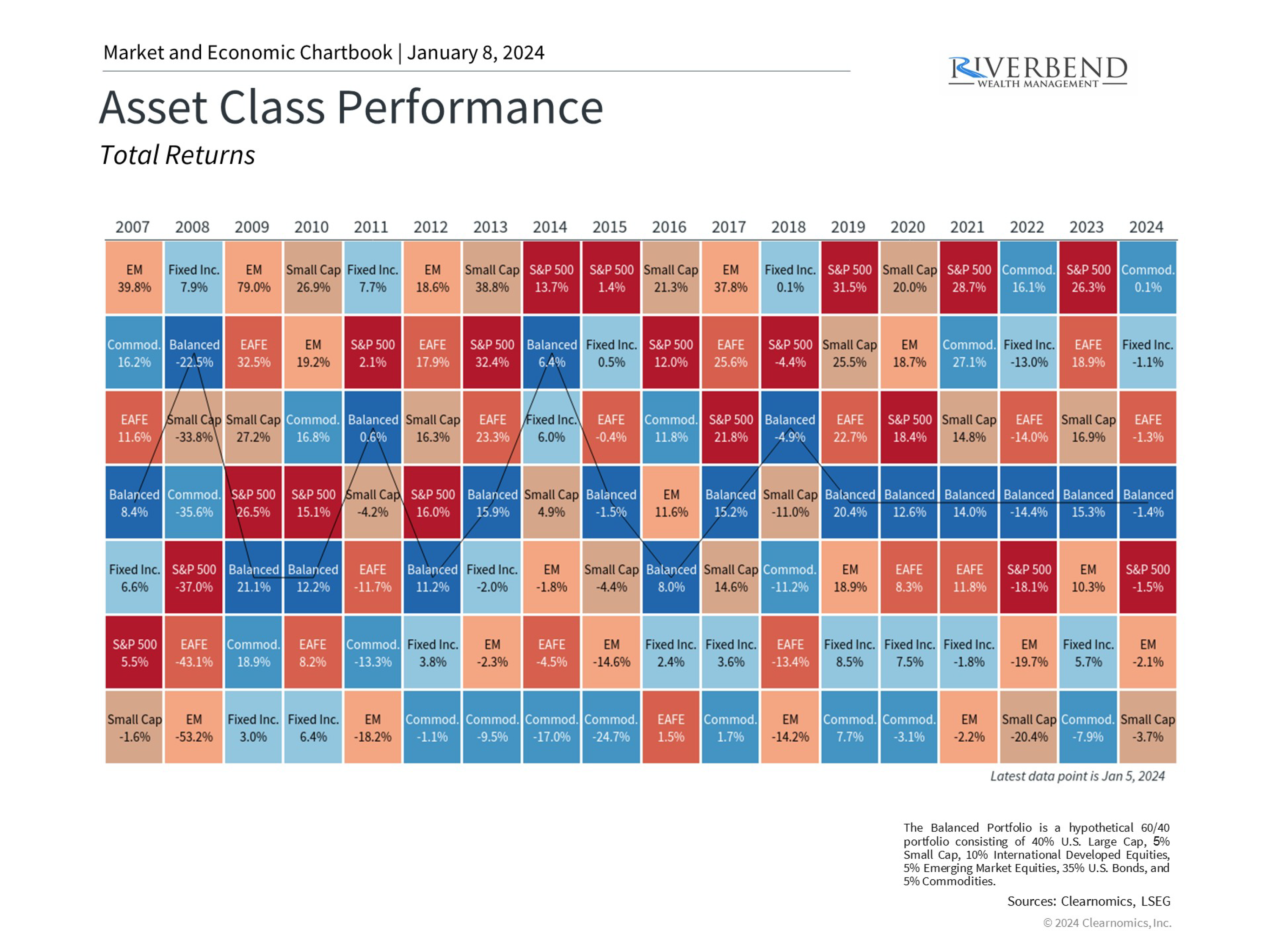

- Diversifying properly across various asset classes is the most important way for investors to weather market volatility.

- The balanced portfolio approximates a 60/40 stock/bond allocation. A balanced portfolio will perform steadily through both good and bad markets.

- It is difficult to predict which asset will outperform from year to year.

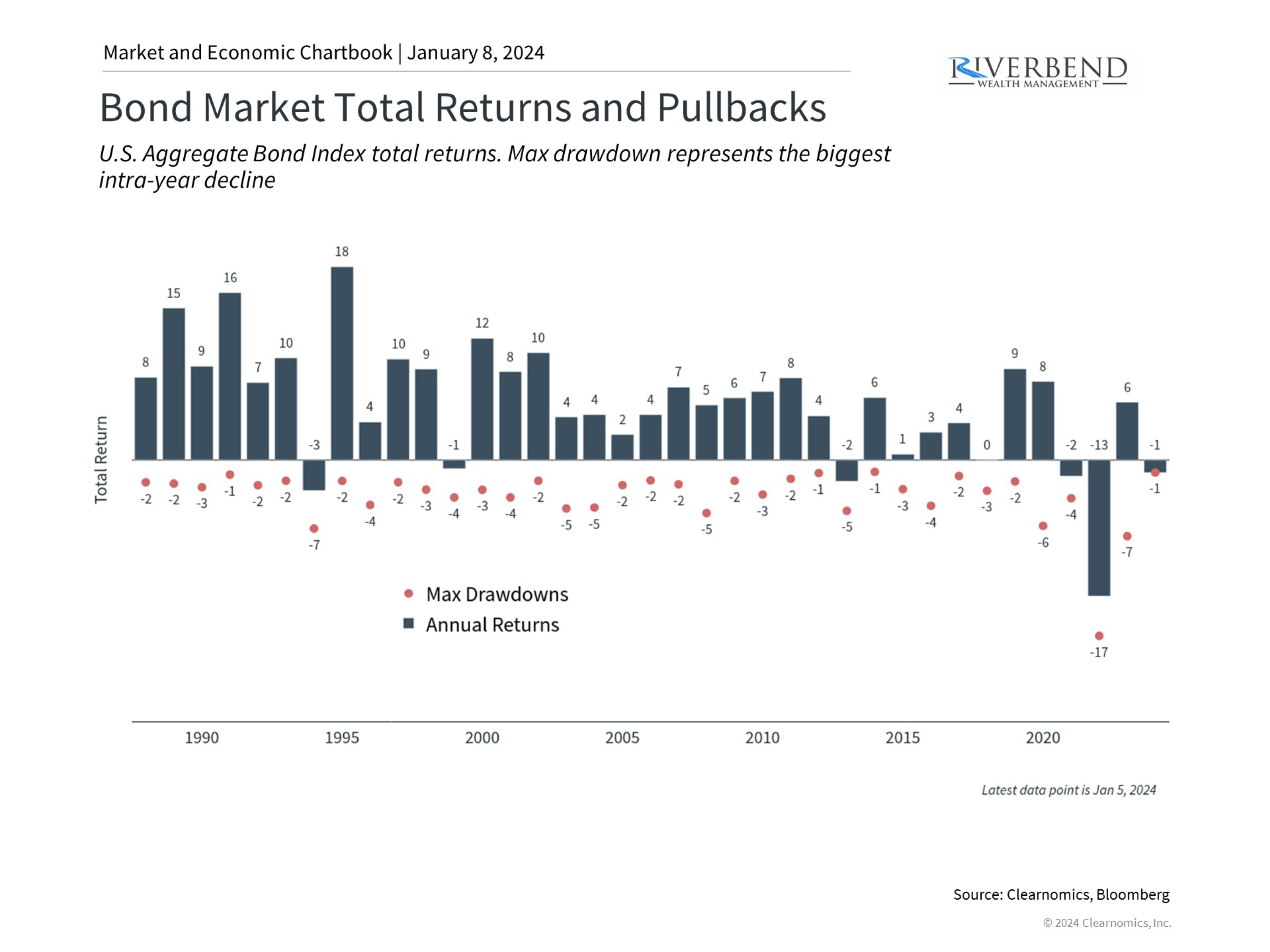

- Despite its relative stability, the bond market can experience significant intra-year declines each year.

- Still, the bond market has ended on a positive note most years, regardless of the level of volatility.

- The ups and downs are a normal part of investing, and investors are often rewarded for staying disciplined through these short-term episodes.

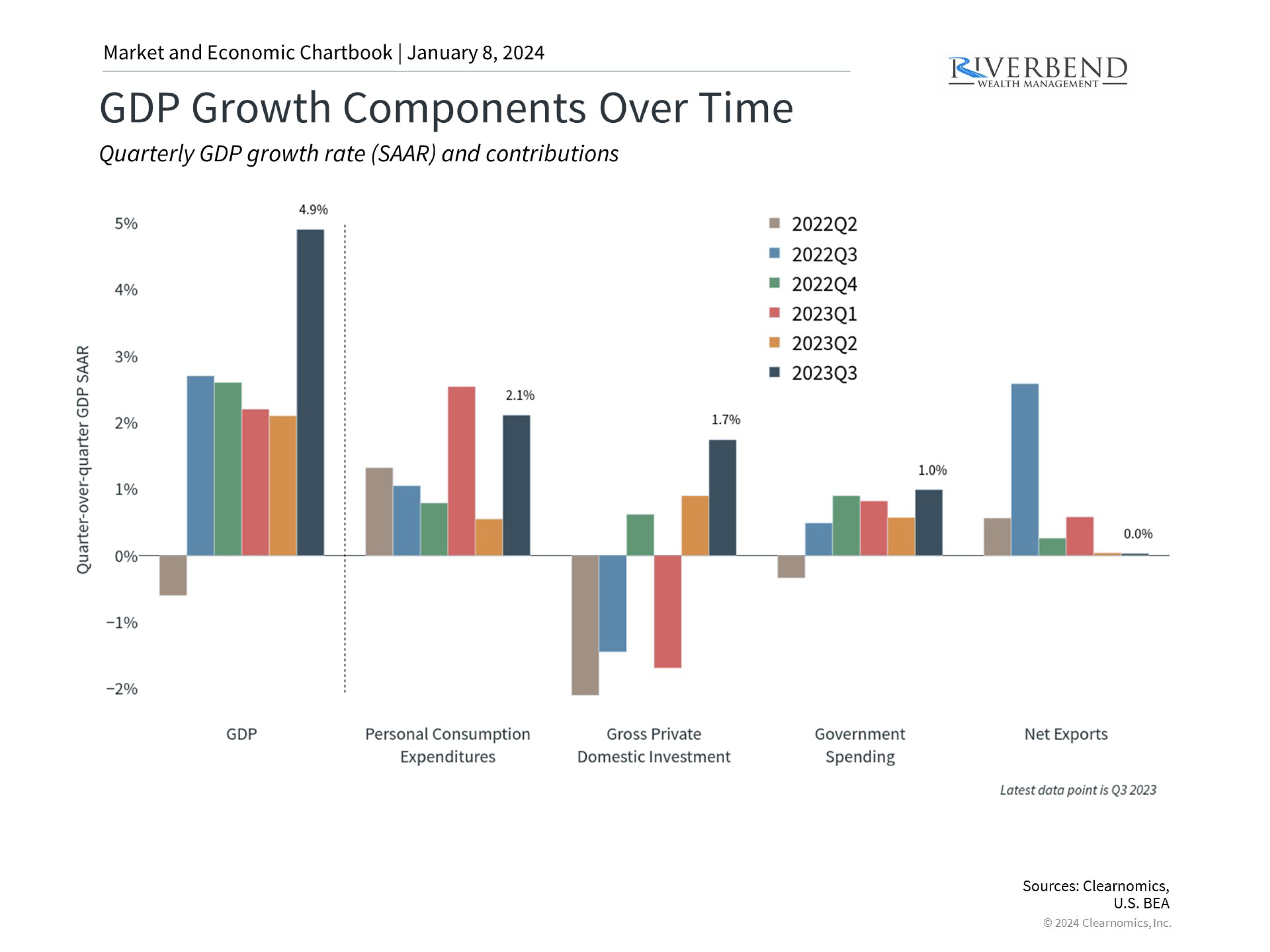

- Fed officials have paused further rate hikes and, according to official projections, could cut rates in 2024.

- Many market-based measures suggest the Fed could cut rates over the next year as inflation approaches its 2% target.

- Personal consumption expenditures have remained positive over the last few quarters, even as the economy slows.

- Investment and net exports have occasionally weighed down the headline GDP number, detracting from overall growth.

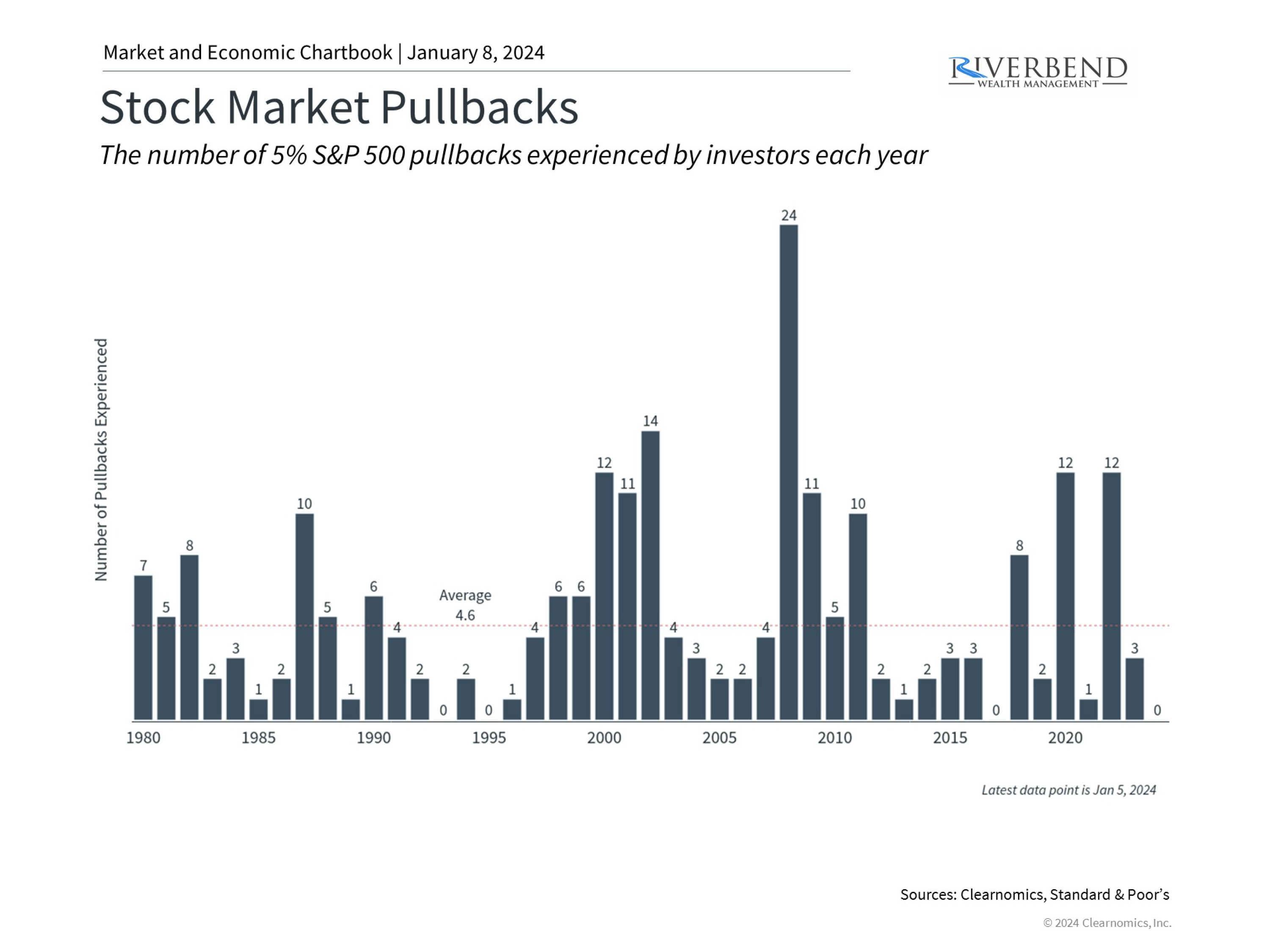

- Investing in the stock market is inherently uncertain. Significant pullbacks can occur at any time.

- Investors experience several significant pullbacks each year with very few exceptions.

- Over the long run, stocks are still the best way to protect and create wealth. Staying invested is thus a necessary discipline.

On the lighter side, Elliott left for college on Saturday—a happy, sad moment. I went fly fishing in Georgetown. Fly fishing combines fishing and hunting because you can spot the fish and try to throw the lure there. It’s not easy, especially when it is windy. The Lowcountry is a beautiful place.

I hope all is well with you and your family,

Jeremy

Finger Financial Five – 5 points in 5 minutes or less – is intended to provide you with a weekly shot of useful financial information. My intention is to share principles so that you will have more clarity, more peace, and make better financial decisions.

Investment advice offered through Stratos Wealth Advisors, LLC, a registered investment advisor. Stratos Wealth Advisors, LLC and Riverbend Wealth Management are separate entities. This content is developed from sources believed to be providing accurate information and provided by Riverbend Wealth Management. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Stratos Wealth Partners and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.