“It’s your road, and yours alone. Others may walk it with you; but no one can walk it for you.” – Rumi

How many clichés have we heard in our life?

Could the reason the saying became a cliché is that it’s actually good advice?

“A penny saved is a penny earned.” Yet, how many of us actually save enough?

“An apple a day keeps the doctor away.” Yet, how many of us eat healthy?

In the financial world, the cliché that stands out for me right now is this: “don’t confuse brains with a bull market.”

Many investments have done well over the past few years. Now I hear people talk about the market being down for a month or even a week as being a bad thing. Ladies and gentlemen, the ups AND DOWNS are reality. To drive the point home, let me share with you a story….

I have always been really good in the sciences, especially chemistry. In college, chemistry has two parts: the class, where we study the theory and the lab, where we do the experiments. I did well in the class, but not as well in the lab. I would rush though the lab and inevitably make mistakes. My thought was, if I knew how things worked in theory, it didn’t matter that much whether I could make them work in real life. Was I ever wrong about that!

We LIVE in the lab. We ARE the lab. We can know it all, but if we don’t live it, are we any better than someone who knows nothing at all? I would argue that knowing and not living would be worse. The former is ignorance, the latter is a choice.

Back to finance…

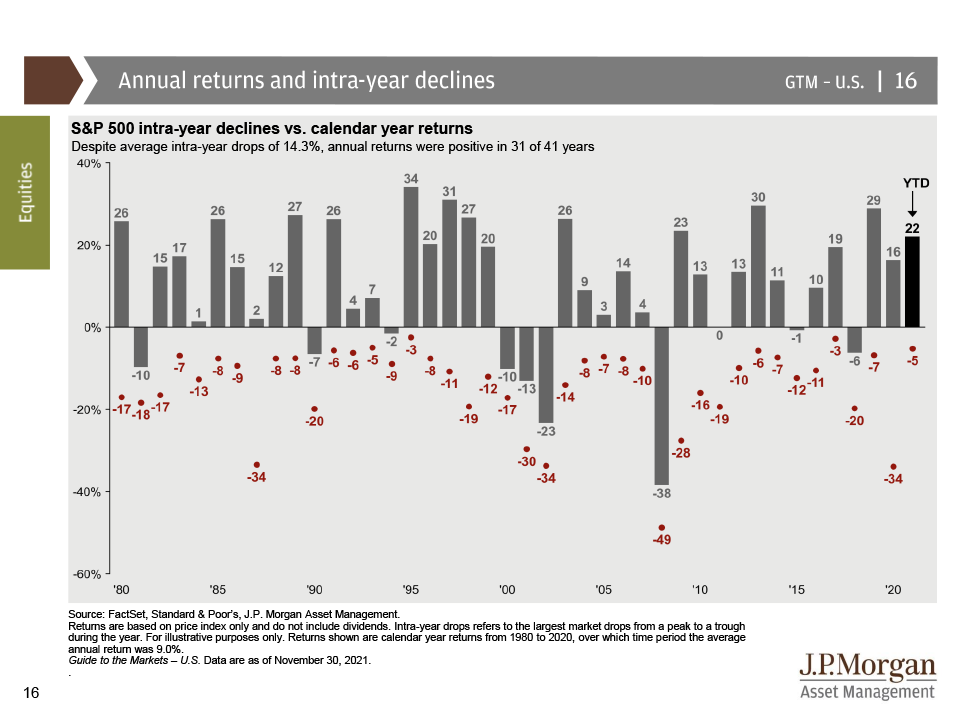

This is a friendly reminder that markets do go down from time to time. On average, intra-year drop is -14.3%. See chart:

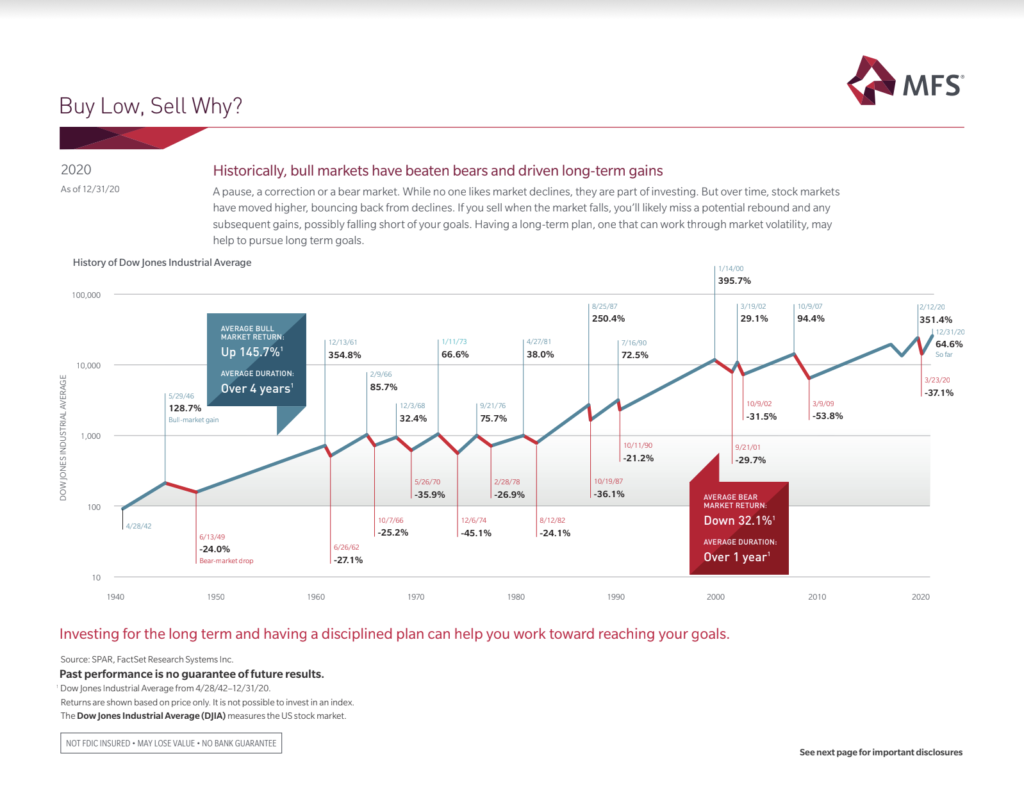

The average bear(down) market lasts a year. See chart:

Please review the charts above again. They are your chemistry “CLASS.” The “LAB” is when you see your account statement and take the proper action/no action. If up, are you going to sell all of your underperforming investments and bet big on your winners? If your statement is down, are you going to sell out and hope to time the bottom? When your neighbor complains that the market is down yesterday, are you going to panic? You are shaking your head no, right? If not, click here for a financial education review. No, not you. You have a plan. You are focused on the long term even while enjoying the short term. You are calm. You focus your attention on what is important in your life because you know your life is your lab and that is where everything matters.

If you have a specific situation you would like to discuss, please let me know. Happy to help. Email me at Je****@Ri*********.com or CLICK HERE for a free 15 min phone appointment.

On the lighter side, my wife and I have been sick. No COVID or flu, just bad colds. We have gone through barrels of tissues in the past couple weeks. I am a lot better now and my wife has made the turn for the better, too. I am reminded of the saying, “a man who is healthy wants a thousand things. A sick man wants only one thing.” Guess we should have eaten more apples…

Hope all is well with you and your family,

Jeremy

Finger Financial Five – 5 points in 5 minutes or less – is to provide you with a weekly shot of useful financial information. My intention is to share principles, so that you will have more clarity and peace, that help you make better financial decisions.

Investment advice offered through Stratos Wealth Advisors, LLC, a registered investment advisor; DBA Riverbend Wealth Management.

This content is developed from sources believed to be providing accurate information and provided by Riverbend Wealth Management. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Stratos Wealth Partners and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.