What I’m about to share is a list of financial targets to aim at decade by decade.

Don’t worry if you haven’t hit every target.

This is designed to help you catch up no matter where you’re starting.

20-29: Laying the Groundwork

The sooner we worry about money, the less we have to worry about it. The 20s are a perfect time to build healthy habits and a strong foundation.

- With any free cash flow, pay off High-Interest rate debt (10% or higher) – (This priority applies to all future decades as well)

- Once the high-interest debt is paid off, try to save ~15% of your take-home pay

- With those savings, establish an emergency fund (Target 3 months of living expenses)

- Those funds can be split up between physical cash, cash at the bank, and Money Market funds. (This tip applies to all future decades as well)

- Once your emergency fund is in place, start investing

- Roth IRA and 401k are great places to start

- Automate deposits into these accounts

- Buy and hold for the long-run (This step applies to the next few decades as well)

- Ideal net worth target by age 29 = 1.5x of your yearly salary saved.

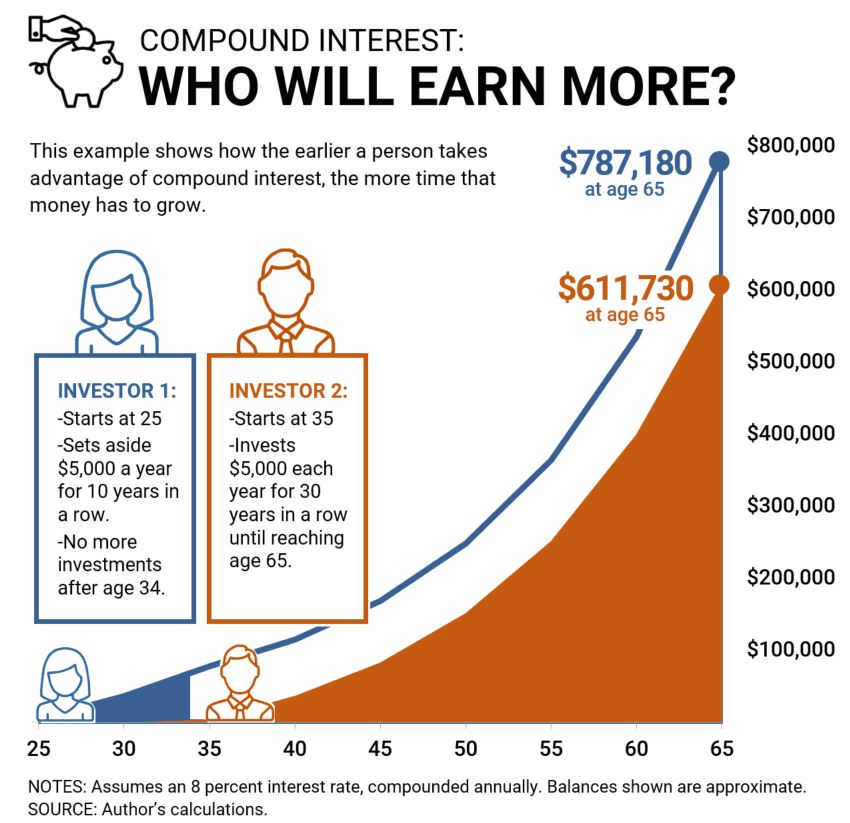

The sooner you start, the smaller the sacrifice needs to be.

30-39: Building Momentum

If you haven’t started preparing for the future financially yet, it’s not too late.

- Save ~20% of your take-home pay

- Boost your emergency fund

- It’s likely that in your 20s, you were comfy operating with a small emergency fund. Now, you might have a house, a family, and other responsibilities. With all that, a stronger emergency fund is paramount. Target 6 months of household expenses

- Open an HSA – If you are eligible, the Health Savings Account may just be the most powerful tool to take advantage of, but only if you use it right. Call us to learn more about that one.

- Consider 529 Accounts – If you have a goal of helping your kids through college, now is a good time to start a 529 plan. Even a small amount can go a long way here.

- If you’re still eligible, max out your Roth IRA

- If you have a retirement account through work, at least contribute up to the amount that the employer matches

- Ideal net worth target by age 39 = 3x your yearly salary saved

40-49: New Priorities

By this stage of life, new responsibilities have arisen. Ideally you already have a strong foundation built. If not, the following items will get you back on track.

- Save ~25% of your take-home pay

- Further boost the emergency fund – target 12 months of household expenses

- Max out retirement and HSA contributions if possible.

- Continue to fund the 529/s

- If you have young children, consider a term life insurance policy

- If you are the major earner in your family, you have multiple kids who are dependent on you, and you haven’t built up enough of a nest egg to support your spouse and kids through adulthood, then term insurance can fill that gap… just in case. A few hundred or a thousand dollars a year could potentially bring your spouse 6 or 7 figures if you pass away. It’s worth the peace of mind.

- If you own your home, target 25% or higher equity by your mid-forties

- Ideal net worth target by age 49 = 5x your yearly salary saved

50s: Bigger Life Milestones

Now you are in your peak earning years. Some people naturally increase their spending with their increased earnings, but this is usually a mistake. You have a major opportunity in front of you to take advantage of. The end result can be more freedom. All it takes is a bit less consumption to get there.

- If you haven’t done so yet, now is the time to do a deep dive into your financial health

- Assess areas where you are ahead of schedule and areas that you are behind schedule. Reprioritize accordingly

- Now may be the time to focus a little less on your kids, and a little more on yourself and your spouse (The healthier you and your spouse are financially, the more you can help them out over the long run)

- Save ~30% of your take-home pay

- Further boost the emergency fund – target 18 months of household expenses

- Start making some extra mortgage payments

- Target 50% or higher equity in your home by your mid-fifties

- Consider building a second income stream

- Max out retirement contributions, HSA, AND catchup contributions

- Consult with an estate attorney about building an estate plan

- Ideal net worth target by age 59 = 10-15x your yearly salary saved

If you have followed this roadmap up to this point, it is likely that you are a Millionaire! If you are not, that’s ok. There are plenty of people who never make it to the millionaire level, and they still live wonderful lives. Don’t be too married or concerned about the numbers we are mentioning here. Again, this is an ideal, and we know that many people have other priorities other than perfecting their financial health.

60s: Preparing for the Next Chapter

Now is the time to put all the pieces of the puzzle together. If you haven’t already, speak to a financial planner who can help you address any remaining gaps, and take advantage of any opportunities you have in front of you.

- Make a plan to retire, or semi-retire (Both financially, and psychologically)

- Shift portfolio to lower risk

- Further boost the emergency fund – target 24 months of household expenses

- Figure out how you want to spend your days

- Save ~35% of your take-home pay in the years that you still work

- Finalize your estate plan, and revisit it after major life events

- Target 75% or higher equity in your home by your mid-sixties

- Ideal net worth target by age 69 = Multi-Millionaire!

AND MOST IMPORTANTLY …

Now is the time to live life on your terms . . . All the sacrifices of the past are about to pay off. What those sacrifices bought you is freedom. Freedom to pursue your passions and to spend your time exactly how you want to.

What milestone are you focused on right now? Hit reply and let me know.

Check out our latest video: Should You Worry About Social Security Going BROKE?