Becoming A Client

Live Your Best Life

At Riverbend Wealth Management, becoming a client starts with getting to know you and how you want to live your life!

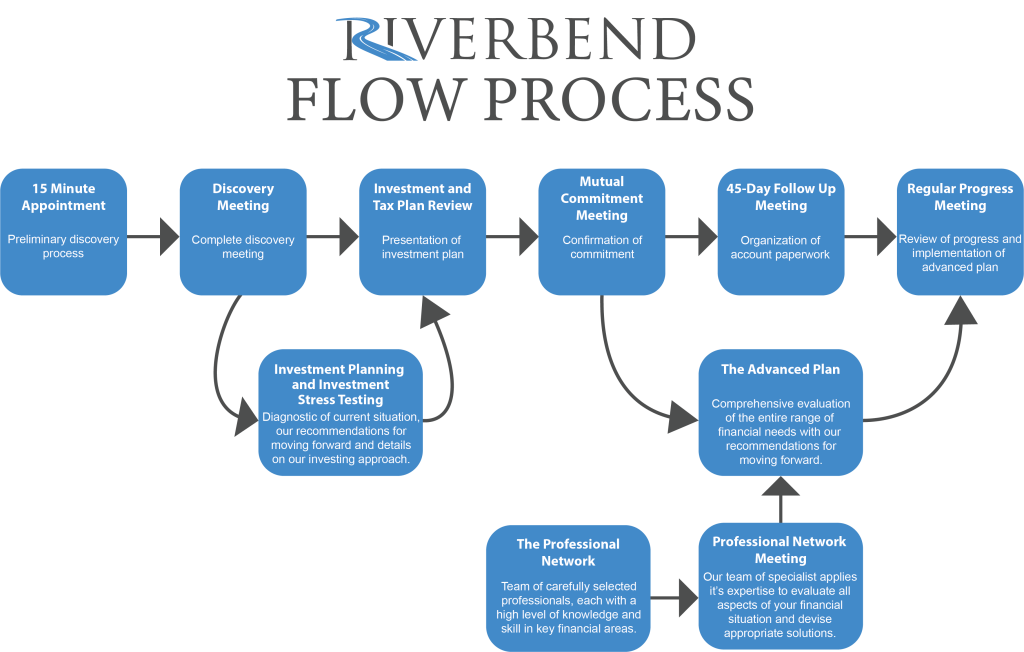

At Riverbend Wealth Management, we believe every client’s journey is unique. Our personalized four-step F.L.O.W. process is designed to understand your dreams and financial goals while fostering a partnership built on mutual commitment. We’re committed to guiding you with clarity and confidence every step of the way. Our complimentary financial assessment is free of charge for you.

Just like a two-man boat, this process is a mutual commitment each step of the way. One can not move forward without the other.

Schedule a Complimentary Assessment Today

Steps To Become A Client

Our process starts with scheduling a 15-minute phone appointment with one of our financial advisors.

During this call, we’ll explore your financial goals and dreams, allowing us to tailor our guidance to your unique needs. If we find that your aspirations align with our expertise, we’ll invite you to a more in-depth Discovery Meeting. Should we feel another resource is better suited to help you achieve your goals, we’ll gladly connect you with the right tools and contacts to set you on your financial path.

Next step in our F.L.O.W process is the comprehensive 90-minute Discovery Meeting. The Discovery Meeting is available either via Zoom or in person at our office located at 1341 44th Avenue North, Suite 102, Myrtle Beach, SC 29577.

Our goal during the Discovery Meeting is to see the world through your eyes and to be a guide to help you align your goals with your finances. There’s no judgement, and there’s no wrong answers and everything is 100% confidential.

Items that we will cover during the Discovery Meeting, to get your full financial picture:

- Values: Explore what truly matters to you and how it impacts your financial decisions.

- Goals: Define both short-term and long-term financial aspirations.

- Relationships: Goals you may have to help your family or friends financial.

- Advisors: Tax, insurance, legal or estate

- Financial Overview: Take a closer look at your current financial situation.

- Process: How you like to communicate.

- Interests: Hobbies, vacation or other

After the meeting, we will create a custom mind map that will be tailored to what is discussed in this Discovery Meeting. Additionally, should both parties agree to move forward, we’ll plan our next steps with an Investment and Tax Plan Review tailored to your needs. This meeting is a crucial step in helping us to understand the full picture of your financial world and paving the way for informed decision-making.

Our Investment & Tax Plan Meeting is designed to provide a clear and comprehensive overview of your financial landscape, for potential clients.

During this meeting the advisor will go over:

- Mind Map: Visually layout every item that we discussed in the Discovery Meeting.

Investment Plan Presentation: We’ll present a high-level view of your tailored investment plan, highlighting key elements.

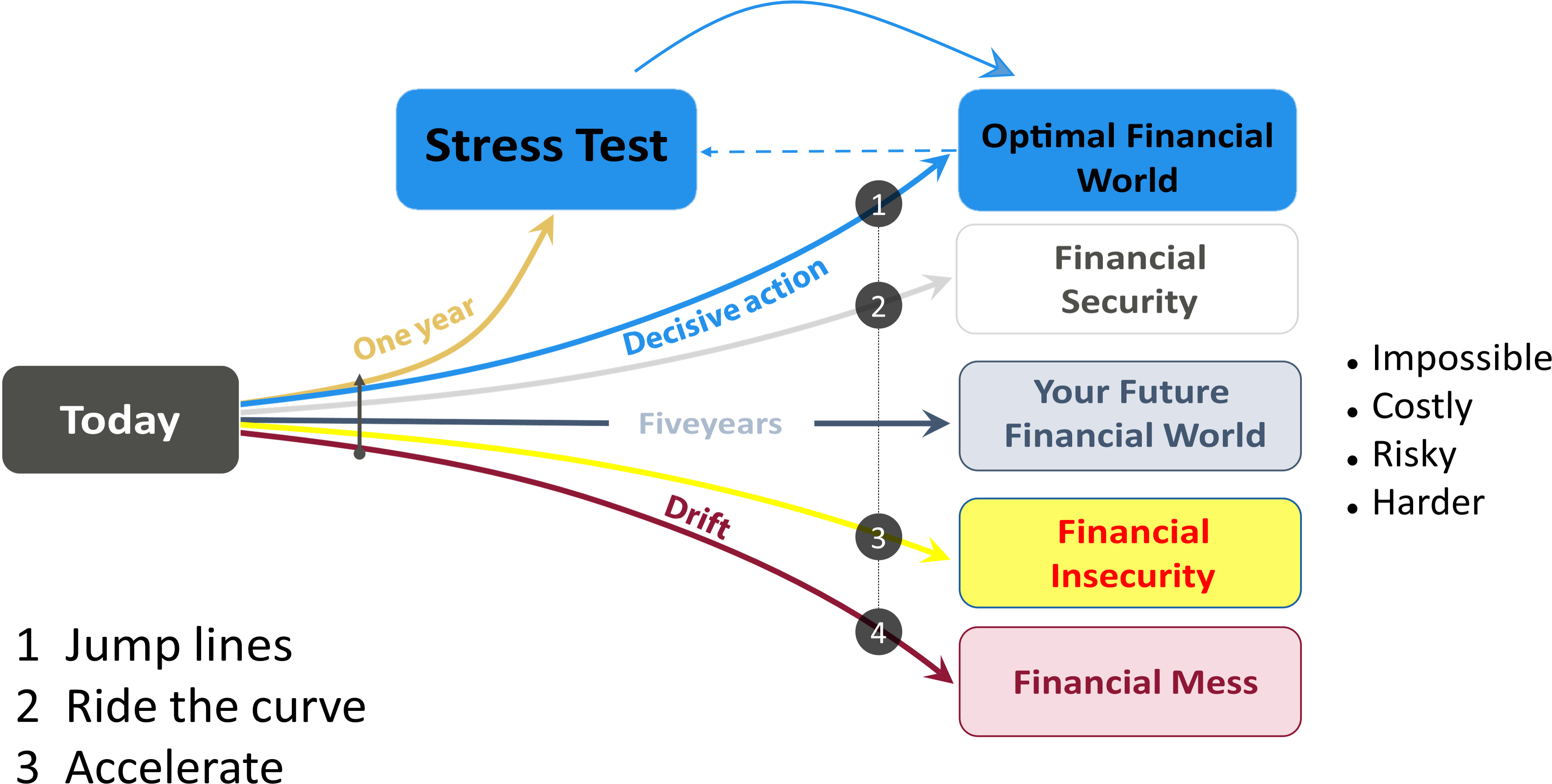

- Stress Test: Review our recommendations for investment approach for your individual financial situation.

Next Steps Overview: Outline subsequent actions to maintain momentum in your financial journey.

Scheduling the Mutual Commitment Meeting: If it aligns with your goals, we’ll set a date for our next meeting to solidify our partnership with the Mutual Commitment Meeting.

This meeting is an essential component of our financial planning process. Our goal is to provide you with the clarity needed to make informed decisions on the next step of your financial journey. Should both parties agree to move forward, we will schedule the Mutual Commitment Meeting.

The Mutual Commitment Meeting where we explore the potential of our partnership before you officially become a client. This meeting can be held either over Zoom or in person at our Myrtle Beach office, providing flexibility and convenience for your lifestyle.

What we will cover in the Mutual Commitment Meeting:

Open Dialogue: Address any lingering questions or concerns you might have, hoping to providing clarity and confidence in your financial journey.

Document Execution: We’ll proceed with the necessary documentation to implement your personalized investment plan.

Second-Opinion Service: If desired, we offer a Discovery Meeting for your friends, family, or associates to explore their financial options with us.

Should both parties agree to move forward, we’ll schedule a 45-day follow-up meeting.

Welcome to your first official meeting as our valued client, held around 45 days after the Mutual Commitment Meeting. This follow-up session is designed to help create a smooth transition and continued alignment with your financial goals.

Open Forum: We begin by addressing any questions or concerns you may have, fostering an open and supportive dialogue.

Life Changes Review: We’ll discuss any significant changes in your circumstances since our last meeting, to keep your financial plan relevant and effective.

Organizing Paperwork: We will check to see if we need you to sign or collect any additional paperwork.

Progress Framing: We’ll examine short-term achievements while maintaining focus on your long-term financial aspirations.

Our goal is to help you navigate the path to financial success with confidence and clarity, with clear and open communication.

The regular progress meeting is provided for all our clients. When we review any financial changes or questions they might have.

Financial Overview: We’ll review any recent changes in your financial landscape and answer any questions to keep your strategy aligned.

Retirement Planning: Assess the odds of success at various spending levels to ensure your retirement plans remain on track.

Investment Strategy: Examine your current asset allocation and discuss any necessary updates to your accounts for optimal performance.

Income and Expenses: A detailed review will help us understand your financial flow and identify areas for potential improvement.

Family Considerations: To ensure they’re integrated into your financial plan.

Insurance Evaluation: Review your current insurance coverage to verify it meets your evolving needs.

Estate Planning: Discuss the status of your estate plan, including when it was last updated and by whom, to ensure it reflects your current wishes.

Roth Conversion Opportunities: Explore the possibility of Roth conversions as a strategic move, assessing their suitability for your situation.

This meeting is designed to provide personalized insights and ensure all aspects of your financial plan are aligned with your evolving goals. We’re dedicated to supporting your journey with a confidential and tailored approach.

Schedule a Complimentary Assessment Today

“We have been clients of Jeremy and the Riverbend team for over two years. We continue to be very impressed with the financial planning expertise and customer service provided by Riverbend…”

– John Houck

“We met with Jeremy today for a free consultation. He is awesome! Gave us some great short-term and long-term advice on retirement planning. No sales pitches or pressure to use their services. We really felt like he just wanted to help us. Highly recommend!”

– Jean Hiers

“I highly recommend Jeremy & his team at Riverbend Wealth Management. This team is honest and conduct business built on integrity and a high level of customer service.”

– Daniel Grossi