Investing is both an art AND a science. Both play their own role in formulating a strategy that stands the test of time.

But first, a short story.

Legend has it that a wise old man invented the game of chess. His goal was to teach people about the value of strategy and resource management. The game became more and more popular throughout the Kingdom until eventually even the King wanted to play.

The King learned how to play chess and absolutely loved it. He felt that the lessons he learned from the game could have a tremendous impact on the Kingdom. The King summoned the wise old man and offered him any reward he wished for giving the Kingdom such a wonderful gift.

The wise old man asked for one grain of rice to be placed on the first square of the chessboard, double that amount of rice on the next square, then double again for every remaining square on the board. The King was amused by what seemed like a trivial request, so he agreed.

When they reached the end of the board, the King owed the wise old man the entire Kingdom.

(When you do the full math equation, the wise old man winds up with quintillions of grains of rice. (1×2 to the 64th power.) In today’s rice-to-dollar ratio (15,000 grains for a dollar), that’s trillions of dollars.)

There are some key parallels from this story that apply to the art and science of investing that go much deeper than the fictional story, and that is what we’ll explore today.

Why Invest Rather than Save for Building Wealth?

We’ve all heard the advice: “Save for a rainy day.” This is sound guidance, but it only gets us part of the way through our journey of building wealth. Why is that?

Inflation: The Silent Wealth Eater

In the year 2000, the median house in the US was about $119,600.

In 2024, the median house in the US cost about $412,300.

Annualized, that is about a 5% increase per year. If we extrapolate that same increase for the next 24 years, the median US house will cost over $1 Million.

It’s not just housing though; I’m sure you’ve noticed insurance, healthcare, cars, food, travel, and many other necessities all cost much more than they did a few years ago. Another way to say it is: Those goods are not going up in cost, instead our dollars are going down in value. That is why simply saving for a rainy day is not enough.

Investing: Combating Inflation to Build Lasting Wealth

While saving money is better than not saving at all, investing puts our savings to work with the potential to grow. Investing can help keep up with inflation or even outpace it entirely. So saving for a rainy day is prudent for short-term needs, but investing is wise for the long haul.

Assets: The Building Blocks of Wealth

When deciding to invest, one must first explore the options available to them. Let’s unpack the different asset categories — each with the potential to play a unique role in a diversified portfolio.

Types of Assets

- Cash is our most liquid asset.

Cash is crucial for short-term needs, but loses value due to inflation. We keep an emergency fund in cash so that its ready to go at a moment’s notice. Whether in a checking account, savings account, money market, or under the mattress, cash is an invaluable aspect of building wealth whether we like it or not. Only after our emergency fund is built are we ready to explore the other asset categories.

- Stocks represent ownership in a company.

The largest companies in the world want access to public financing, so they offer ownership shares to the public. Investors like you and I then get to participate in the upside if the company appreciates in value. Stocks trade between millions of market participants and fluctuate in value daily based on market news, business updates, technological advances, competition, and many other factors. (Many stocks also offer a ‘dividend’, which is a regular payment to its holders for owning the stock.)

Exchange-traded funds (ETFs) and mutual funds are pooled groups of multiple stocks and are usually the best vehicles to consider for beginners rather than picking individual stocks.

- Bonds are loan contracts to governments or corporations that pay interest to the bond-holder.

Governments often need to borrow, so they offer bonds with set interest rates attached. A $1,000 bond may have a 5% interest rate for 1 year. Meaning at the beginning of the year, the bond buyer loans $1,000 to the government. At the end of the year, the government gives back the $1,000 plus the 5% interest or $50.

Bonds also trade on the market daily, generally with less upside and downside compared to stocks. So you don’t have to buy a bond new, and you don’t have to hold it through the entire contract.

- Real Estate is all forms of buildings and land.

Real Estate can be Residential, Commercial, Farmland, or undeveloped. Land or buildings can generate income or appreciate in value. Unlike other assets, we can borrow large amounts to get into this market, allowing us to take advantage of leverage. (Which can be dangerous if we are not careful). On the positive front, real estate can provide ‘passive income’ but on the negative side; it is relatively illiquid.

- Alternatives:

This category includes commodities like gold and oil, as well as more volatile assets such as collectibles and cryptocurrencies. Specialists in various subcategories of alternatives use this as a portion of their investing strategy. This is an area that non-specialists should proceed with extreme caution. (Some categories of alternatives are considered riskier than others)

Investing is Not Gambling: Building Wealth Strategically

When taking the wrong approach, investing can be quite close to gambling, and the results can be similar if not worse. Think of it like a spectrum with one far-end being the irresponsible gambler and the other far end being the ‘0-risk’ investor. Most of us are somewhere in the middle of that spectrum, and there are methods we can utilize to get some reward while not taking huge amounts of risk.

Understanding the Probabilities

There are no certainties in investing. The wise investor sees the world through the lens of probabilities. We know that inflation is a likely outcome for cash. We know that quality assets have performed well over time. Knowing that, it’s fair to assume that the probabilities are in our favor if we invest in proven quality assets, and they are out of our favor if we don’t.

Putting the Odds in Our Favor

Markets are inherently unpredictable, especially in the short-run. In the long-run though, we can tilt the odds in our favor by following the concepts that have stood the test of time. We will go more in depth on these as the article progresses.

Getting Comfortable with Volatility

Volatility is inherent to financial markets, reflecting the constant ebb and flow of investor sentiment, economic data, and global events. Recognizing this can help investors maintain a long-term perspective and avoid the emotional pitfalls of short-term market fluctuations. While volatility cannot be eliminated, certain strategies can help mitigate its impact.

Historical Perspective

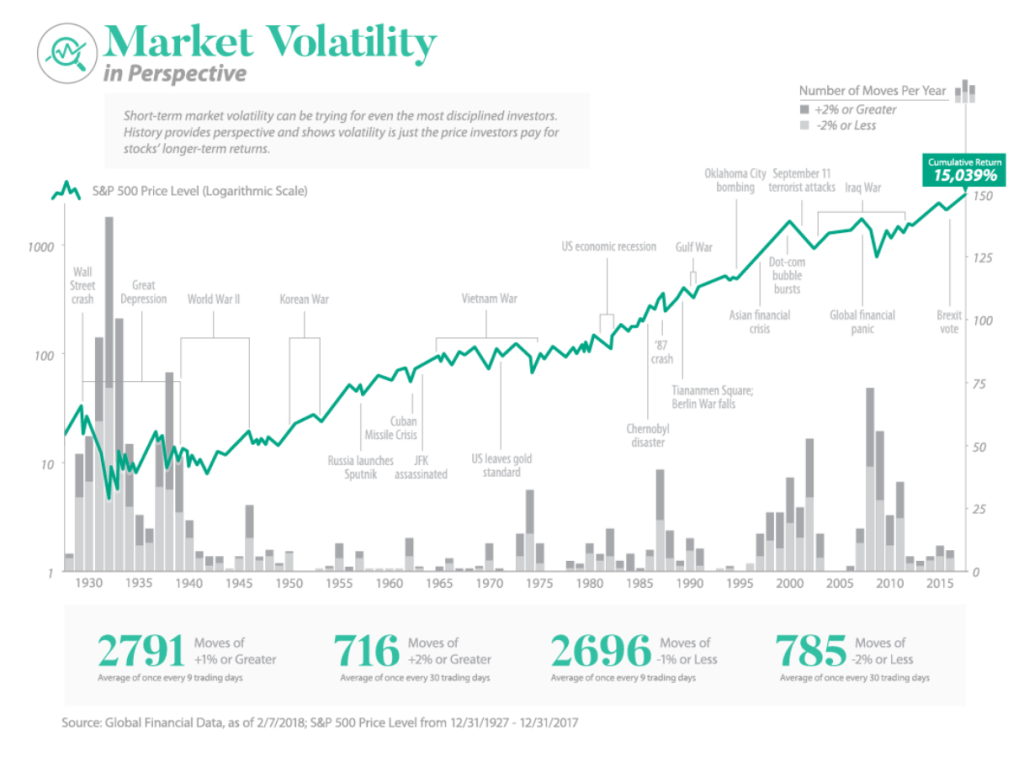

Markets have always experienced cycles of highs and lows. During the lows, it pays to zoom out from the short-run data and remember the long-term trend. This green line below shows the historical price level of the S&P500 (500 of the largest companies in the US). The gray bars show the frequency of the fluctuations of the pricing (Higher gray bars indicate higher volatility). And layered onto the chart are significant historical moments that had potential impacts on markets.

Managing Volatility

While there are actionable steps that can help mitigate volatility, arguably the most important lesson is to learn how to manage our emotions. This is a huge aspect of the ART of investing. If we are unable to stay calm during volatility, then all the technical knowledge in the world does not do much good.

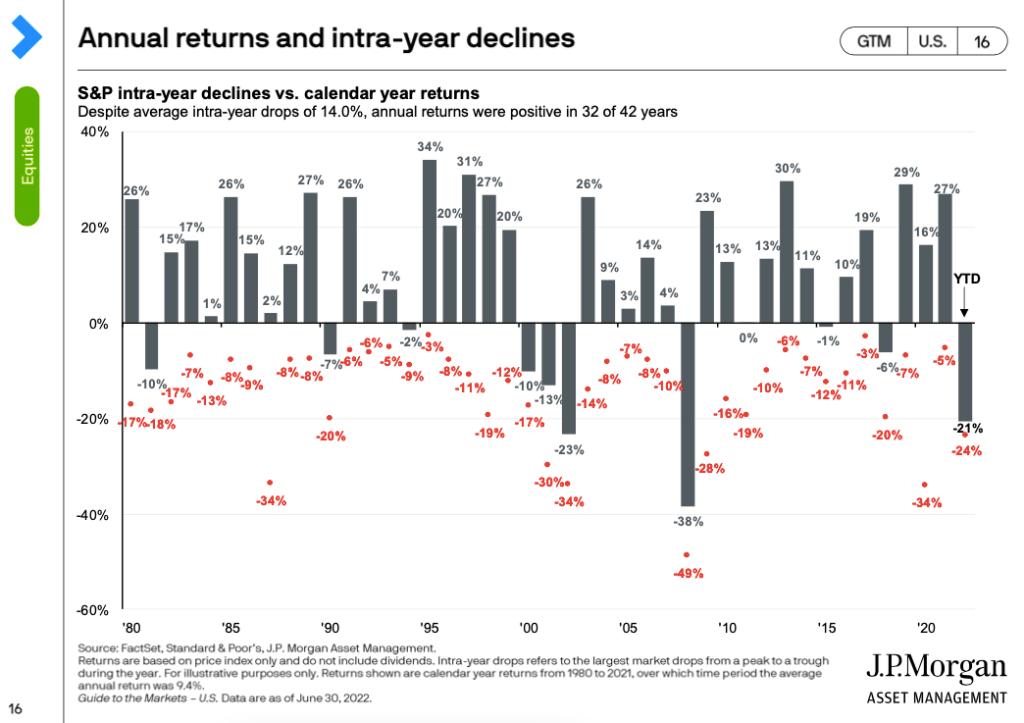

This chart below highlights the low points of the market from 1980 – mid 2023, and where the market ended each of those years. The red dots represent the low of the year, while the gray bar represents the value at the end of the year. What you’ll find is that every single year was negative at some point, but about 3 out of 4 of the years ended positively.

I’d like to highlight a few specific years and some examples of how that may have played out in an investor’s portfolio. This can help us manage our own emotions if this ever happens again.

- In 1998, the market was down 19% at one point during the year, but ended the year up 27%.

- In 2009, the market was down 28% at one point during the year, but ended the year up 23%.

- In 2020, the market was down 34% at one point during the year, but ended the year up 16%.

In the following examples, we’ll take approximate averages of those 3 swings rather than highlighting each one individually.

In real numbers, if you have $1 Million fully invested in the S&P500 at the start of the year, it could go down to about $780,000 at one point during the year if it follows a similar trend to some of those years above. Please take a moment to reflect on your own emotional response if on one quarterly statement, your investments show $1M … and the next quarter, it shows $780,000.

The key lesson here is two-fold:

- If you hold on through the downturn, your portfolio would be back in the $1.2M range by the end of the year.

- If you panic or can’t stay the course, you lock in your $220,000 loss, and wind up missing out nearly half a million dollars in gains from the low point.

Moments of downside volatility are very difficult, but if we are able to stay calm, holding on for the long-run is usually the better move. In fact, the best move might be to invest MORE when the market is down, which is why keeping funds on the sidelines in cash ready for events like this can be quite prudent.

For instance, if you had $700,000 invested, and $300,000 in cash in a similar situation to the above examples: Then the $700,000 would have gone down to the $550,000 range at the low of the year, but you still have your $300,000 cash. That would still leave you with about $850,000 total as opposed to about $780,000 for the person who was fully invested.

Then you would be able to decide at that point if you want to deploy some of the $300,000 in cash into the market to take advantage of the current discounts. Those funds that get deployed will take advantage of the next upswing if/when it occurs.

Generally speaking, those with higher tolerance for risk can stay closer to ‘fully invested’ and those with lower tolerance for risk can keep a larger cash cushion. This helps to regulate our emotional responses to the market volatility.

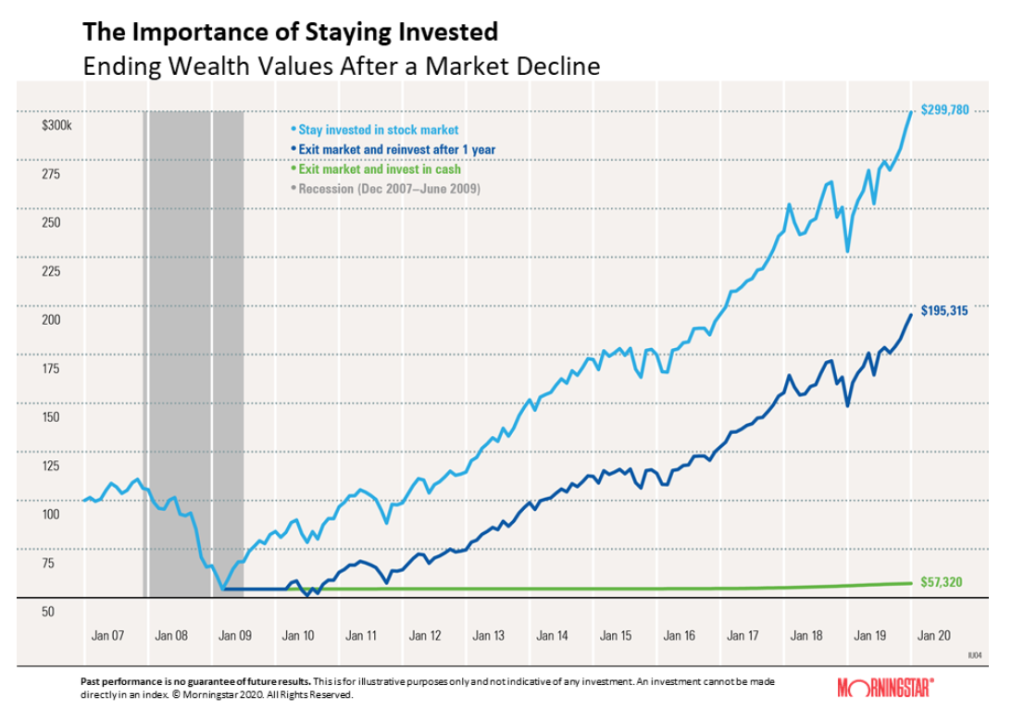

This graphic below shows the difference between staying invested (light blue), exiting the market then reinvesting a year later (dark blue), vs exiting the market and staying in cash (green).

Investor Psychology and Emotional Regulation

Investing is more than statistics and analysis, it’s also a mental and emotional game. In fact, some argue that psychology (The Art) plays a more significant role than technical knowledge (The Science).

Common Mistakes

Trying to predict the market’s next move, is like trying to catch lightning in a bottle – exciting, maybe, but futile and dangerous. TIME IN the market has been better than TIMING the market.

Greed is most common when markets are doing well. Fear is most common when markets are doing poorly. Warren Buffet encourages us to do the exact opposite: “Be fearful when others are greedy, and greedy when others are fearful.”

This graphic below shows the natural emotions that we experience as the market goes through ups and downs.

The Winning Traits

Investing isn’t all about avoiding bad habits though. There are good habits that can be cultivated that are just as impactful in the other direction such as patience, humility, and discipline.

Blending the Art and The Science

1. Choosing Quality Assets = Importance of Discipline

Not all assets are created equal. Focusing on high-quality assets gives our investments good upside potential while also being resilient. It takes some discipline though, because there is always going to be news about the ‘next big thing’. If there is some new untested asset that we are interested in, a disciplined approach would be to take 1% of our portfolio to invest in it rather than 100%.

2. Asset Allocation and Diversification = Embracing Humility

No single investment can guarantee success. By diversifying across different asset classes and sectors, we can spread risk and increase the likelihood of stable returns. Humility helps us recognize that nobody can predict which assets are going to perform best in any given timeframe.

3. Time and Compounding: = Practicing Patience

Albert Einstein allegedly referred to compounding as: “The eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” Just as the rice grains on the chessboard were negligible in the beginning, the compounding effect is most powerful when given time.

Investing is both a science and an art.

The science:

- Understanding why to invest rather than just save

- Understanding the various assets that are available to us

- Seeing through the lens of probabilities rather than certainties

- Practicing the strategic principles that have held true over time

The art:

- Psychological regulation

- Learning how to ride the waves without panicking

- Not allowing emotions to make decisions for you

- Practicing discipline, humility, and patience

At the beginning of this article, I shared a story about a wise old man who conquered the Kingdom by applying the correct knowledge and strategy. Our own Kingdoms will be built the same way.