Hello, everybody, this is Jeremy Finger with Riverbend Wealth Management here in Myrtle Beach, South Carolina. Welcome to the call. The call today would be market volatility and what you specifically can do today and in the near future to help your financial position. There are a variety of different demographics on the call, so there could be many things that may pertain to you in some that may not,okay? What I encourage you to do is ask a question, just click the Q&A, ask the question and and I’ll try my best to answer every question and I’m going to use, when I go through this, I’m going to use examples, use some slides. So pretty quickly, OK? I encourage you also to have a pen and piece of paper and write down whatever may stick in your mind. And if you got questions about that, you can ask me on this call or you can send me an email text or a phone call and we can discuss it on a one off basis. OK, so a little bit about me.

I grew up in Nickols, South Carolina, about an hour west of here with the College of Charleston and studied Biology, Chemistry and Business. I graduated from there, applied for a job in Charleston, a job in Myrtle Beach as a financial advisor, and I’ve been doing this for over 23 years. I’m a certified financial planner and a certified investment management analyst, and I got that at the Wharton School of Business. Thank you again for the for this call, the intent for this is not only giving you actionable ideas. It’s also able to put true out to share with you some perspective on what we’re in today. And be able to deliver this information to you. Quickly, timely, authentically and in the comfort of your own home. And this is a rarity. It’s a rarity that I’ve experienced being able to do this for clients or any financial advisor doing this for clients. So let’s just jump right in. First off, I do want to talk about the virus, the Coronavirus out there. That’s one of the main causes of the volatility we’re seeing right now. Number one thing to do is be healthy. Try social distancing, which, by the way, hopefully you’re doing by being on this call in the comfort of your own home, but also you try to get some exercise, walk outside, enjoy the weather, those of you who are in South Carolina. We’ve had some pretty good weather right now, order takeout, most restaurants are closed. Order takeout tip your waiters and waitresses who do boxset stuff up. You know, they are going to be struggling in this period of time. Communicate with your family. Read a good book, board games, all the things we used to do 30, 40 years ago. Just pretend like we’re just jumping back in time for the moment, so. The volatility with the market, okay? So there is a lot going on and it’s all on the news, and I do want to share with you some of the things that put this in perspective.

Remember to ask questions. Alright, here we go. So what has the greatest impact on investment results? This is time and time again the biggest, biggest harmful action on harmful catalyst investment results is investor behavior. US stocks in this particular example here from 1998-2018 average of 7.2%. The average investor, I’m talking about stock investor, is average 3.4, that is typically by people adding money in when the market’s high and selling with the market’s low. And I’ve seen people do this time and time again. And let me see if I can do a quick poll here. I will launch a poll, How many of you know, someone who has sold their stocks, whether they currently are in the financial crisis of that 10 years ago, believe that poll going on for right now and we’ll see what the results are there. Alright, 100% says yes, so far I’ve got a couple of nos. Alright, so right now we got 2/3 of the people said they have heard, they do know someone who sold their stocks and we’ve got one third of the people said they do not know of anybody who sold their stocks. So 7.2% versus 3.4%, that’s a gigantic difference. And so a lot of people are saying, well, what’s the experience of this mutual fund versus that mutual fund? And that does matter. The giant difference is investor behavior, making sure that you’re dealing with someone you trust and there’s a variety of different factors that will go over that would help alleviate some of this investor behavior from helping from causing you and your family harm. All right.

Alright, so let’s just say you’re invested for 20 years. The average annual return for stocks is, average annual return for stocks is 7.2% as we’ve seen before, and if you put $100,000 invested in 1998, just put it in stocks and got the great return of the index, you would have averaged 7.32% and got $410,000. Now, this is crazy, but if you only miss 10 days out of 20 years. 10 days out of 20 years, your return would have gone from 7.32 down to 3.78. Alright, so instead of being 410,000, 209,000. Just 10 days being out of the market, just 10 of the best days being out of the market, your returns drop dramatically, dramatically. Now, the crazy thing is, the very, very best days tend to happen right along some of the worst days, okay? October 2008, September of 2008, November of 2008. And so we cannot predict when these best days are going to be, my goodness, I wish we could. I really do. But that’s just not possible. And so I’ve got clients who say, you know, in some other people, those of you who are clients, typically I’ve had this conversation with you before and you know what I’m about to say but it is impossible, really to say, oh, you know, the market’s high. Let’s sell out now and then we’ll buy back in. First off, you got to be exactly right twice, sell it right and then buy it back in right.

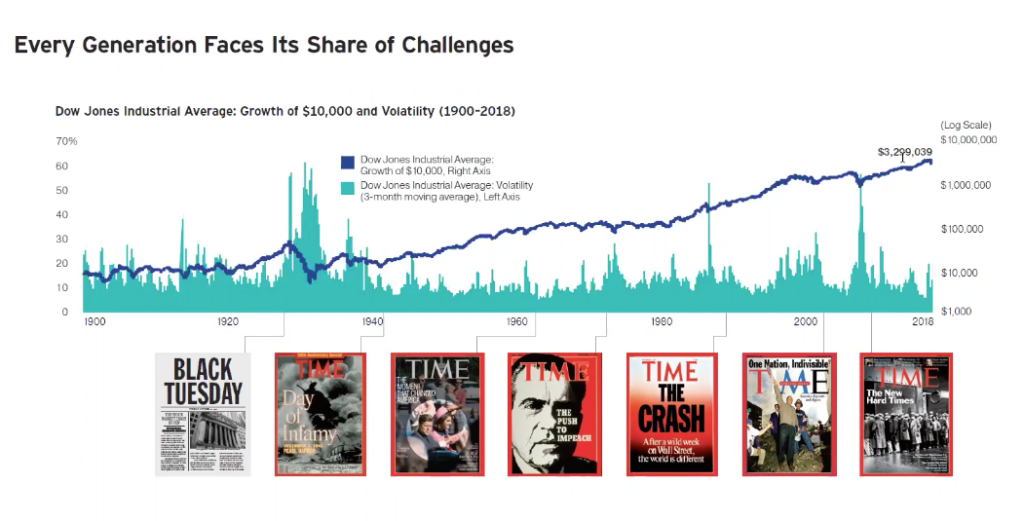

I have in 23 years in reading dozens and dozens and dozens of books and thousands of hours of conference calls I have never heard of anybody successfully and consistently being able to do that. Now, I know plenty of people and they know what I’m doing, right?. Yeah, I sold out, this is back in a financial crisis. I sold out of 12,000 with the idea of getting back in 10,000. Well, as you know the market ran up to $29,000 and census retreated back to 20,000 but it is very, very difficult. It’s really impossible to be at a time the market so what’s really important is to stay invested, stay invested. If you’ve got good investments and we’ll get into that a moment. These things here, alright, so bad news, bad news. Man, I tell you what, you know, how much news is out there right now, is cash all the time. So there is always, always, always bad news out there and bad news is really at the peak of market volatility. So, good friend of mine we talked about this other day, he says well if we know there’s bad news coming or worse news is yet to come, You know doesn’t that mean the market’s going to go down? Not necessarily, and then we tell you why. The markets are a leading indicator, meaning that before the bad news comes. Typically the market is already anticipating that in reaction to it, just as you get off already experienced here now the market it really has gone down dramatically in a very short period of time anticipating earnings being poor for the second quarter and the third quarter and possibly the fourth quarter. They’re already anticipating that. Real example here is in gas, don’t hold me to it exactly, but the peak of unemployment, back in the financial crisis was in November of 2009 at 10.2%. The market hit dead bottom March 9 of 2009, so about 6, 8 months before. If you waited you probably would have missed a 30% to 40% increase in the market value of the stock, it’s a leading indicator. You can’t wait, let’s just wait for the market sells, wait we hear some good news, by the time it happened the darn things up, it’s just up. Questions, comments, questions, no open questions, alright. Volatility does not equal financial loss, unless you sell. Now, some of you guys may have some of this, who said you should sell and I’ll talk a little bit about that or reallocate to say it that way, but when when markets go down, it doesn’t mean that you’ve lost. So this is, each year ’84,’86,’87 and years in between. This is what the total return of each year and what the market was doing at that time or was the absolute low of that year. Francis, in 1984 the peak bottom with 13% loss in 1985 the bottom was -8% but the market, ended up 6% here, up 32 percent and so on. The peak bottom of 2008 was 49% loss but ended up only being down, only beind down, can you believe that I’m saying that? 37%. So, what you’re seeing here is the average gain owned during the year is minus 9.9% but the average annualized total return in this example here 84 2008, 2013. So just because it’s down in the middle of the year doesn’t mean it’s going to end that way. Alright, just volatility is part of it. Again this is all stocks. Most if you, do not have all stocks. So, how long’s it last? Downturns last. When did we’ve ever seen this before,drawdowns of 5% to 10%. It happened 40 times. It happened 40 times since 1945. In the recovery time, 3 months. 10% to 20%, 7 months. 20% to 30%, 25 so recoveries can vary on how long it takes time how long it takes to recoup. I do want to show you one more graph. You see which one I want to show you here. If I had a great singing voice how I’d go ahead and sing for you. Everybody will certainly drop off. There’s so much information out there. And I see so much of it. So that is say, to disseminate all that information and give it all to you would be very difficult to do but I just wanna give you some bullet points. Again, this is an Annualized return. The green and the downturns of a red, as you can see there’s a heck of a lot more up than down, 1926, 2019, let’s see. Okay, here you go. Negative news, SMP 500. When the SMP 500 was dropping in 2009. Viewership of CNBC spiked. And then as the SMP 500 rebounded, viewership seemed to drop, so people just like bad times, I mean it sells. Unfortunately, I guess this, we’re sick. We are part of the problem, of this drama, we tend to overshoot on the upside and overshoot on the downside. So yes, we’re part of the problem. A few things that you can do, right now those of you who are not retired yet, continue to save, okay? Make sure you have a good investment, I’ll review anything you have with no obligation, whatsoever and you can either do it yourself or stay with the advisor you’re in. No questions asked, okay? If you are not retired and you’re in you’re able to save, save. The second best thing you can do is don’t sell. Dividends are constantly being paid depending on what types of investments you have and when your dividend reinvestment, if you don’t sell, you’re buying more shares when the price of low, right now the price is low and so when things do rebound your account values go up, a heck of a lot more than that went down. And the absolute worst thing you can do, is sell out completely. What you can do is to rebalance, okay? Right now, a number of things that people can do in their taxable accounts, is they can take, not a tax guy, I’m not I’m a CPA. This is just a tax planning advice, you could sell one investment and reallocate it to a different investment, take the tax loss. And then when things rebound you’re going to participate on the upside with the new investment. Why would you do that? There’s a few different reasons why, number one, you’re taking the tax loss and you’ll be able to hold on to that tax loss to all set in the games you’re gonna have in the future number 2, is when you rebalance into a different investment, if you got a good advisor you know, obviously ask me, is that you may be upgrading your portfolio. I mean, maybe you are upgrading the quality of the investments that you have right now, so tax loss harvesting. Another thing you can do, those of you who have IRA accounts, and let’s say for instance, this is going to be a challenging year for you income wise so your tax bracket may be low. Since your IRA is dropped in value, You may be able to convert that IRA to a Roth IRA. And then you have to pay taxes on whatever you convert, let’s just say your traditional IRA dropped to 50. You take 50,000, move over to a Roth, you got to pay taxes on that $50,000 now. And then now, your money’s in a Roth IRA and it grows based on current rules, tax free. You can withdraw it tax free as well. So now is a great opportunity to take care of Roth conversion. Those of you who are nervous about the market and their approach to retirement or absolutely can’t sleep at night or whatever, annuities could be an option because I’m a fee only financial advisor, we can get some cheap annuities with guaranteed income streams there. The flexibility to get in and out of the midst maybe, ask me questions, okay ask me questions if you want to know about that. Also fund your HSA account, your Health Savings Account. You get the tax deduction on the front and grows tax free, comes out tax free, for any health related expense. These accounts, IRA’s 401Ks, anything you got to contribute to for the 2020, try to do it now if you get the cash flow to do it, okay? Alright, “Hey Jeremy I’m retired and I’m living off my money and so how is that gonna happen how’s that gonna work” or “Hey I’m retiring in a few years you know, I’m concerned about this and will I be able to retire? Guys and gals, if I did a plan for you, it includes periodic times of bear markets. It includes periodic times a bear market. It is not like you know, these plans are designed for only an 8% return every single year. It is preparing for times like this, up and down, up and down, up and down up and down. Now, what are some of the things you can do in this particular time? Many clients, I encourage them to have Emergency Funds set aside. Those of you or those that are taking income, you know, now’s a great time to use some of the cash set aside for their living expenses now. First is liquidating some of their investments at a low price, wait this thing out. For those of you, for any of you, really. There are some investments that have actually done very, very well in this environment, US treasuries being one of them. And they’ve gone ridiculously, in my opinion, high and it’s just best to sell it and and put cash on the sidelines. Many of you have done that, many of you who are clients. You may not know this but I was being a little strategic and a little defensive with your money in the beginning of the year so the downside even though you experienced it is much much less than it could have been. So there are pockets of investments that if you don’t have cash already in the bank to be at the weather this downturn. Weather the downturn meaning living off your income, there are may be some in some portions of your money that can be sold to generate cash for you to live off of, you know, for 3 months, 6 months, to a year to wait this thing out and go on that way. Again, Have a plan, everyone of you who have a plan with me. I have designed the plan accordingly to withstand some of these downturns that does not mean your investments don’t go down. What it does mean is that if I told you an income that you could receive from it, it’s about the same. Now, what I would encourage you to do, right now is if you got a major expense coming up and you can defer that expense later, wait to buy car instead of going to Europe for a vacation you know, maybe go to Florida. Try to defer and reduce your expenses today, because all we don’t know exactly how long this recovery might take. It might be 2 months, it might be 3 months, it might be 6, months, it might be a year. Nobody knows for certain, okay? but if you have cushion, that is going to help you reduce investor behavior, investor shock. If you have a cushion on during, the cushion of cash, it’s easier to not be so emotional. Those of you have kids or grandkids and are contributing to further education.

Imagine you’re looking at a valley, when you get across the valley, right? Yeah, that may have a bit of walking to do it but you actually know that you can get to the other side. Now whether that be the end of this year or at the end of next year. We will recover, okay? We will recover. Now, will businesses be the same? Some businesses especially in Myrtle Beach, it may hurt some golf courses and restaurants and hotels, absolutely. That’s real, even though the virus may not be you know, prevalent. It may hurt some of these people, absolutely the case. But going forward, are we going to recover? My goodness guys, absolutely we will recover. Will the landscape a little bit different? Well, maybe. Maybe this type of call is the new normal. Okay, maybe this type of call is the new normal and and instead of doing face to face meetings all the time, we do webinars like this. Maybe we start staying at home more. I don’t know. Now I’ll say this, is that medical technology probably increased, testing will increase, emergency precautions for outbreaks like this will increase, there is many, many, many different kinds of history some of the best businesses were born in the area of crisis, okay? Microsoft and Apple started in late 70s for example so there are going to be some good changes and developments because of this but again, that’s part of the valley, guys. Is that making smart decisions, do what you can today. Try to be a little bit more frugal with the dollar, half cash on the sideline when appropriate, take advantage of tax loss harvesting if you can. Call me, text me, email me. No matter what, no obligation whatsoever, okay? I’ll be willing to help you in any way possible. So questions, any questions? If someone can, now, again, I love you but I’m kind of new to this technology, if you could ask a question, do so. If you can’t, if there’s something up with the technology, I’ll fix it make sure it’s right, next time. I am planning on doing conference calls like this on a regular basis so if you’ve got a topic or concern or something you’re interested in, let me know and I’ll make sure I bring it up on the next call. My telephone number is 843-222-6602. Email address is Jeremy@riverbendWM.com. Call me, email me, anytime. Update your plan, update your will. That’s it, so thank you very much for your time if you again, got a question about anything, be sure to give me a call, oh here’s a question. By the way all these questions are anonymous, okay? In the last major downturns, how much is the average dividends reduced owed by companies conserving cash? Oh that’s a great question! So in other words for example, great example, this happened today and at least, I think I heard it today, is Ford Motor Company was paying a dividend and today, because of the slowdown in the economy, they cut their dividends. So it’s like how much in the last major downturns has the dividends being cut? I can’t, I don’t know but I can find that out. I can find that out. Some companies could cut their dividends in financial downturns. Now, part of upgrading your portfolio is doing what? Purchasing company, good solid balance sheet companies that typically have sustainable dividends even during downturns, okay? So if a company is over leveraged and has all this debt, they may not be able to sustain the dividend. Great question, one other thing that they mention, my goodness, is this: Inflation. Alright, so inflation is 2.1 in this particular example. The Cash is paying virtually nothing right now, okay? The 10-year treasury bond that fluctuates a little bit but let’s just say it’s right around 1%. The current dividends, the current dividend rate on the SMP 500 is, guess what, if you get into 1% on the US treasury, I mean, it what do you think you’re getting on the stock market? or just the SMP 500? It’s yielding 2.5%. Right now, over 2.5 actually. So you’re making 2.5 times the income. On your stocks, than you do on cash. Fast forward across, visualize being across this valley I’m referring to, of the recovery. Let’s say it’s 2 years down the road, let’s say it’s 5 years down the road. 5 years down the road, would you be better off selling out and going to cash at 1% or maybe holding some good quality companies that are paying 2%,3%,4% or more. And holding them for 5 years. The issue lies ahead, Jeremy, I’m retired, I need my money now. Let’s say, you’re retired right now. Nobody needs all their money, right now. Typically the withdrawal rate from their investments is right around 4% they have 96% of their money still invested and that is, the dividends are reinvested, buy more shares when the price is low and when the recovery does happen the portfolio is fantastic. Now, I’ve got clients who are retired with me for well over 20 years. Well over 20 years, I’ve only been 23 years but, so they’ve been through the.com bust, they’ve been through 9/11. The financial crisis and they still play golf, they still went out to dinner and they still live their lives to still play with their grandkids and everything else. Sometimes when things are good, they go to New York Prime. If things are like this, maybe they go out to dinner, a bad example now because restaurants are closed but maybe they go to Applebees or they go to snack shack. So the people tend to, you know, when things are well, they spend more, when things are not as good as they spend less. This is one of the times when you can, if you can, spend less. Any more questions? That was a great question. I have to tell you I’m really excited about the technology here, to be able to communicate to you and everyone in a very timely efficient fashion and truthfully be within the comfort of your own home. Anything else? Okay, wonderful. Thank you very, very much for attending and let me know if there’s a topic you want to hear about. Email me, text me, call me. I’d be happy to review anything you want me to answer, any question, okay? No obligation to do business with me, let’s just suppose for instance you did want to do business with me, all your money with be held at fidelity investments, an 8 trillion company that took no tarp money. I mean, they typically pay four times the amount of interest of money as well. We could do all this virtual, I can do docusign where you don’t even leave your house and set everything up. So, just a thought, for those of you who are clients that want to review your investments and your financial plans, that’s fantastic, email me and we’ll set up a time to do just that. Alright, God bless you and have a good night.