“Peace is not the absence of chaos or conflict, but rather finding yourself in the midst of that chaos and remaining calm in your heart.” – John Mroz

I took my first finance class at the College of Charleston 30 years ago. Wonderful class taught by Professor Collins. One of the main talking points during 1991 was United States debt. We are still talking about it to this day.

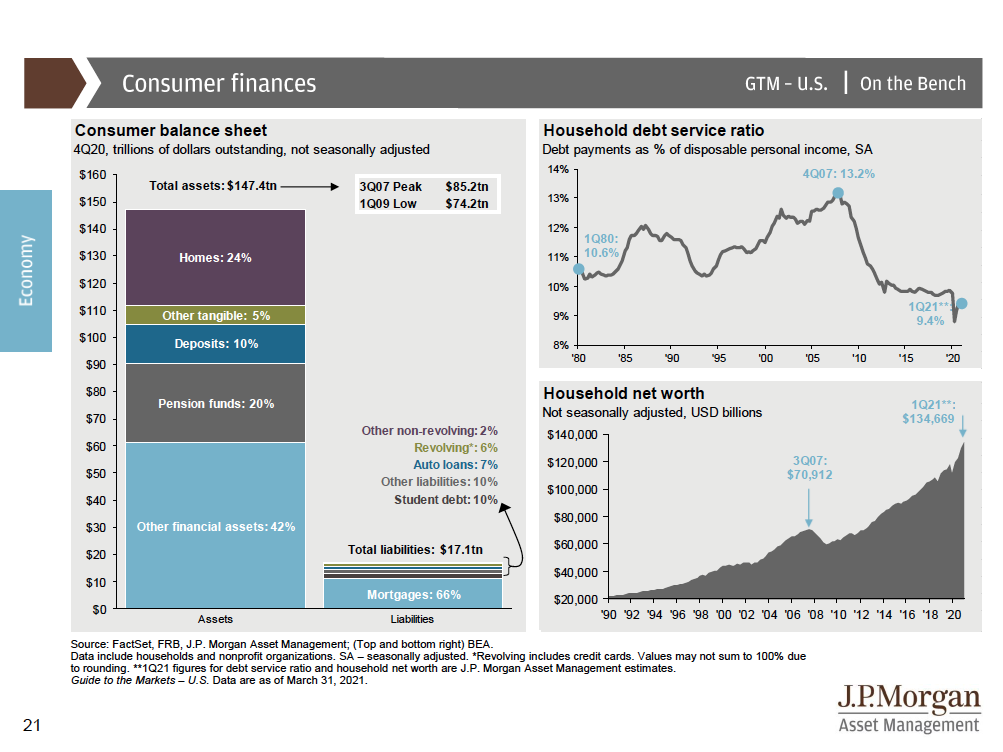

One of the biggest concerns about debt is “can I afford it?” In other words, can I make the payments? Many people are concerned about the United States and its debt service. Well, let’s take a quick look …

From the 1980s-2000s, our total US debt service cost was about 2.5-3% of GDP.

This is equivalent to you making $100k/yr with debt payments of $250/mo. Pretty manageable.

Markets at all-time highs – Why? Because profits are at all-time highs…

Investing at all-time highs can be uncomfortable, but not if you look at the big picture.

Household net worth has never been higher. Interest coverage of debt is near all-time lows.

But, but, but Jeremy, what if Inflation rises, taxes go up, GDP falls, and we go into a recession?????

First, I would say we are healthy enough economically to handle the downturn.

Second, and in a Finger Financial Five fashion, I share with you a story…

A few years ago, I went with some friends and hiked 24 miles down into the Grand Canyon and back out the other side. It was a breathtaking sight. I mean absolutely awe inspiring. Some of the trails were only 6 feet wide and did not have guardrails. You if got close to the edge and slipped, it will be your last. What do you do? Not hike? Not take in the view? Read about it in a book? No way! How about walk in the middle of the trail? You take in almost all of the view with no risk of falling.

The same is true when investing. Maybe you can reduce your expenses close to zero and be fine. That would be like reading about the Grand Canyon instead of experiencing it. You would be leaving a lot of life on the table. How about, instead, invest in the middle of the road and enjoy the view. What does that mean?

-

Have at least one year emergency cash. We had plenty of food and water on the hike.

-

Invest accounting toward your risk tolerance and income goals. We went as fast as we could, but within our comfort zone.

-

Be as tax efficient as possible when investing and when taking withdrawals. We did not carry unnecessary items. A hiking mantra is ounces equal pounds, and pounds equal pain.

-

Live within your means. We were prepared to hike the Canyon, not Mount Everest.

-

Have a retirement plan. We mapped out our course.

-

Have a network of good people to help you. We had an experienced guide every step of the way. We did not hike alone. Safety in numbers.

My intention for you is that you live your best life. To do what warms your heart. It will not always be easy. There will always be uphill to downhill. Rain to the sun. Upwind to downwind. Upstream to downstream. This is ok – it’s life. Prepare, accept, and take the first step.

Let me know if I can help you in any way. Feel free to call me at 843-970-1043, email me at Je****@Ri*********.com or setup a phone appointment.

On the lighter side, I took the family to Palmetto Bluff this past weekend. A friend of mine has a place there. It is a very nice resort where you can fish, paddle board, bike, and do other outside activities. Elliott took a friend. I did not know it at the time, but his friend has never gone beyond 50 miles of Myrtle Beach his whole life. Almost everything he did was new to him. He had a great time, as did all of us. He was very appreciative of the trip. For some people, their only option to travel is to read a book or watch a video. Makes me think of how fortunate we are. Some have not had the opportunities we have had. Even though their first steps are on a trail much different than mine, our best ones are almost certainly at the edge of our comfort zone.

Hope all is well with you and your family,

Jeremy Finger, CFP®, CIMA®, CRPC®, CPFA

Founder & CEO

Wealth Management Advisor

Finger Financial Five – 5 points in 5 minutes or less – is to provide you with a weekly shot of useful financial information. My intention is to share principles, so that you will have more clarity and peace, that help you make better financial decisions.

Book 15 Minute Phone Appointment – CLICK HERE

Direct: (843) 970-1049

Cell: (843) 222-6602

Email: Je****@Ri*********.com

1111 48th Ave. North, Parkway Office Plaza, Ste. 114

Myrtle Beach, SC 29577

www.RiverbendWealthManagement.com

Investment advice offered through Stratos Wealth Advisors, LLC, a registered investment advisor; DBA Riverbend Wealth Management.

This content is developed from sources believed to be providing accurate information and provided by Riverbend Wealth Management. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Stratos Wealth Partners and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.